Difference between Mutual Funds vs Chit Funds

|

Basis |

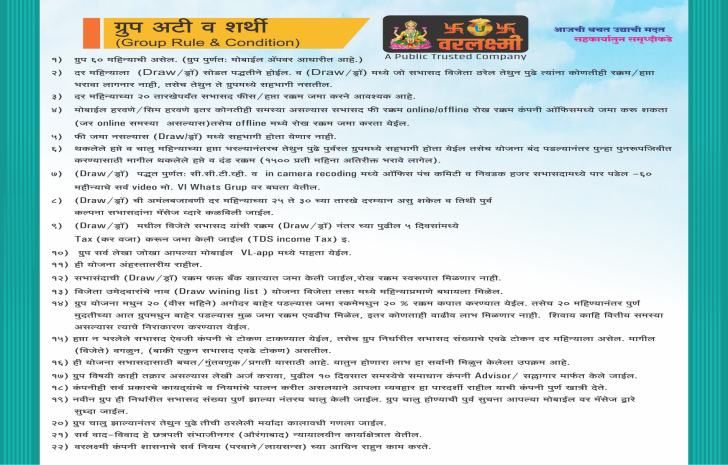

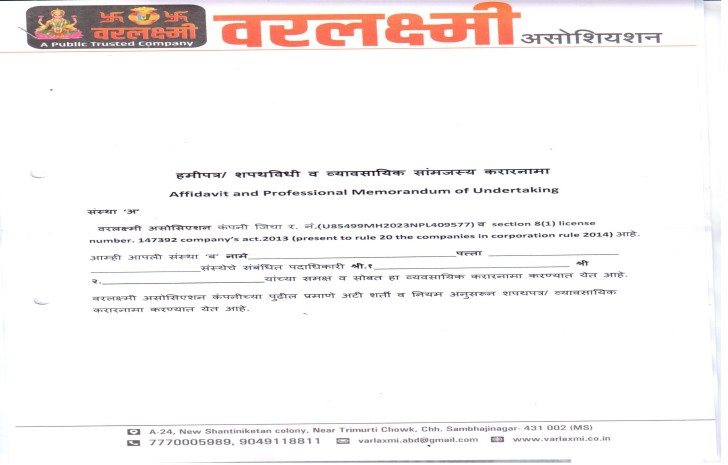

Chit Fund |

Mutual Fund |

|

Purpose |

The purpose of a chit fund is two-fold - borrowing and saving. |

The purpose of a mutual fund is to assist in investment as well as savings. |

|

Government regulations |

As per Section 61 of the Chit Funds Act 1982, the state government appoints the registrar of chits for the respective state. |

The mutual funds in India are regulated by the Securities Exchange Board of India (SEBI) |

|

Taxation rules |

As per the Income Tax Act, the chit funds are taxed as ‘income from other sources.’ |

The taxation rule for a mutual fund depends upon the type of fund you have invested in. |

|

Return possibilities |

The rate of return varies from one chit to another. |

The rate of return of a mutual fund is dependent on the strategies of investors and market performance. |

|

Market volatility and risks |

Chit funds are safe from and not exposed to the risks prevailing in the market. |

Mutual funds are highly affected by market risks and volatility. |